China cuts benchmark lending rate to shore up growth

Xinhua

20 Jan 2022, 15:48 GMT+10

BEIJING, Jan. 20 (Xinhua) -- China on Thursday cut the market-based benchmark lending rate, in line with market expectations as authorities stepped up monetary support to shore up the economy.

The one-year loan prime rate (LPR) came in at 3.7 percent Thursday, down from 3.8 percent a month earlier, according to the National Interbank Funding Center.

The over-five-year LPR, on which many lenders base their mortgage rates, was lowered by 5 basis points to 4.6 percent.

The monthly-released data is based on rates of the central bank's open market operations, especially the medium-term lending facility (MLF) rate. Banks are required to set rates for new loans using the LPRs as the benchmark.

The move came in line with market expectations as the central bank on Monday cut the interest rates of the MLF loans and reverse repos by 10 basis points to lower lending costs for businesses.

Although China's economic growth saw a strong year-on-year rebound of 8.1 percent in 2021, authorities have warned of the triple pressure of demand contraction, supply shocks, and weakening expectations amid an increasingly complicated external environment.

Going into 2022, the macroeconomic environment would be less benign as the stimulus in the advanced economies is being withdrawn while the developing countries still face substantial challenges related to the ongoing pandemic, which will result in weaker export demand, supply bottlenecks and cloudy global prospects, noted Martin Raiser, World Bank's country director for China.

At a press conference on Tuesday, Liu Guoqiang, deputy governor of the People's Bank of China, called for "opening up the monetary toolbox wider" and moving ahead of the market curve to combat downward pressure on the economy.

Since the latter half of 2021, policymakers have been on the move. The central bank has cut the reserve requirement ratio (RRR) for financial institutions twice to offer liquidity to the real economy and launched targeted policy tools to guide money to the desired industries.

The cuts in the LPRs will produce positive effects in expanding domestic demand, stabilizing external demands, and ensuring stable development of the property sector, commented Wen Bin, chief analyst at China Minsheng Bank.

Going forward, China's policymakers will continue to rely on RRR, open market operations, MLF and other monetary policy tools to maintain a reasonable abundance of market liquidity, Wen said, adding structural monetary policy will also be adopted to increase precise support for areas including small and micro enterprises, scientific and technological innovation, and green development.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Argentina Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Argentina Star.

More InformationInternational

SectionDeadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Putin fires transport chief, later found dead in suspected suicide

MOSCOW, Russia: Just hours after his sudden dismissal by President Vladimir Putin, Russia's former transport minister, Roman Starovoit,...

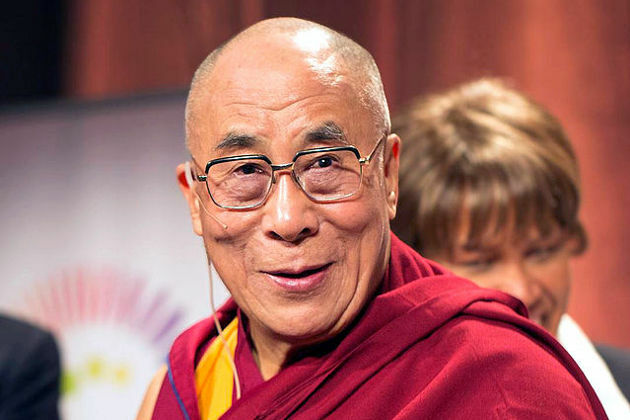

Thousands gather in Himalayas as Dalai Lama celebrates 90th birthday

DHARAMSHALA, India: The Dalai Lama turned 90 on July 6, celebrated by thousands of followers in the Himalayan town of Dharamshala,...

Fans perform WWII-era Fascist salute at Marko Perković’s mega concert

ZAGREB, Croatia: A massive concert by popular Croatian singer Marko Perković, known by his stage name Thompson, has drawn widespread...

U.S. Treasury Secretary says Musk should steer clear of politics

WASHINGTON, D.C.: Elon Musk's entry into the political arena is drawing pushback from top U.S. officials and investors, as his decision...

TikTok building U.S.-only app amid pressure to finalise sale

CULVER CITY, California: TikTok is preparing to roll out a separate version of its app for U.S. users, as efforts to secure a sale...

Business

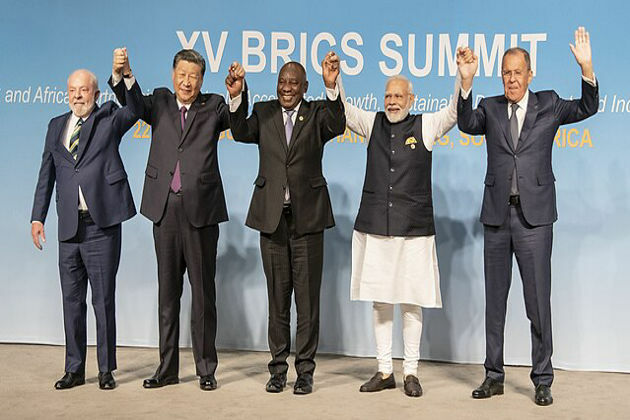

SectionBRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...

BP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...

FedEx, UPS step up as Canada Post loses market share in strikes

OTTAWA, Canada: With Canada Post struggling to maintain operations amid labour unrest, rivals like FedEx and UPS are stepping in to...

U.S. stocks steady Tuesday despite tariffs turmoil

NEW YORK, New York - U.S. and global markets showed a mixed performance in Tuesday's trading session, with some indices edging higher...

Beijing blamed for covert disinformation on French fighter jet Rafale

PARIS, France: French military and intelligence officials have accused China of orchestrating a covert campaign to damage the reputation...

Birkenstock steps up legal battle over fakes in India

NEW DELHI, India: Birkenstock is stepping up its efforts to protect its iconic sandals in India, as local legal representatives conducted...